How to Make Buying From Your Dealership Easy

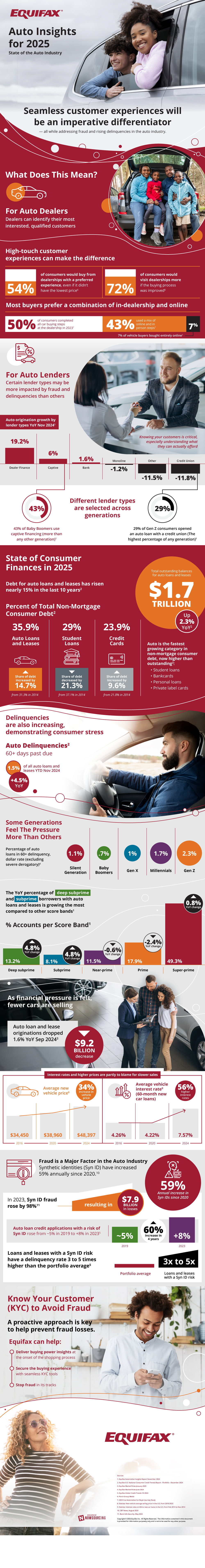

Today, customers have several more options when buying a car. Not only can they shop at local dealerships, but they can also check online to browse a dealership’s inventory across the country. Not only can they see a plethora of cars, but they also compare prices nationwide. With the sheer number of options that a customer has, the key to attracting a customer lies in customer experience. Statistically, over half of customers claimed that they would buy from a dealership where they had a better experience, even if it’s not the lowest price offered on a vehicle. Moreover, 72% of consumers would visit dealerships more if the buying process were improved, which further reinforces this notion.

However, the introduction of the internet is not only a change in the car buying process. Nowadays, the financing of a car seems to be consolidated around traditional methods and away from alternative ones. Financing with your dealership, for instance, has seen a whopping 19.2% growth in just a year since November 2023. Similarly, financing with the maker of the automobile grew by 6% in the same period. However, during this time frame, financing with a credit union and many other miscellaneous financing methods fell by 11.8% and 11.5%, respectively.

Moreover, the consumer debt has seemed to shift towards the automobile industry as well. Since 2014, the total amount of debt for auto loans and leases has risen 15%, which marks the fastest-growing non-mortgage consumer debt. As of November 2024, the total of all outstanding balances for auto loans and leases is $1.7 trillion, which is up 2.3% since last year. With the rampant growth of automobile debt, auto delinquencies have followed.

An auto delinquency is a loan or lease payment that is 60 days or more past due. Presently, it sits at 1.5% of the entire $1.7 trillion outstanding balance, which is a growth of 4.5% since last year. This number is not evenly distributed across all generations, however. The younger the generation, the more likely the auto loan will be delinquent. For instance, only .7% of all Baby Boomers have auto delinquent loans or leases, whereas 2.3% of all Generation Z financing agreements are considered delinquent.

The combination of all these factors has pushed the origination of new auto loans and leases to drop by 1.6%, which has cost the automotive industry a $9.2 billion decrease. Couple this with rising new car costs and rising interest rates, and it can make it difficult to get customers to sign, and even harder to make sure they won’t be delinquent. This further emphasizes the importance of a positive customer experience as soon as they walk through the door.

Fortunately, companies now offer Know Your Customer (KYC), which helps to smooth out the entire buying experience. It works by verifying the buying power of a prospective customer and providing it to the dealership in real time. Not only do they make the buying experience seamless, but they also help to protect against fraud from synthetic identities. Ultimately, to make sure your customers have a good experience at your dealership, taking advantage of KYC technology from Equifax is the best way to go.

Post Your Ad Here

Comments