What is the tax audit for?

The increase in volume and quality of the controls carried

out by the collecting agencies has caused a growing interest of the companies

to know their situation before having to face the Treasury.

Although the need to "cure in health"

predominates, the purposes of improving the efficiency of the internal

organization are not less important, evaluating the technical capacity of the

personnel in charge of these tasks and defining their training, anticipating a

possible sale of the company. That will impose a review on behalf of the buyer,

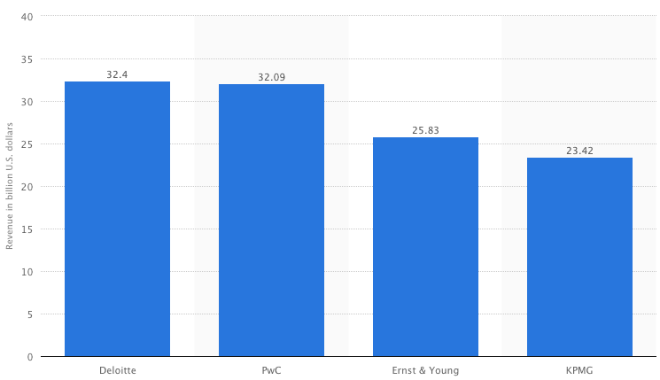

among others. If you need any help from the expert, here is the best tax firms.

Work team

The tax audit is a professional service that is carried out

by a multidisciplinary work team that analyzes the tax situation of the

company, reviews information and detects evidence that verifies compliance with

tax regulations.

Within this review process, our experience indicates that multidisciplinary

in work teams, integrated by accountants and lawyers, is a key factor that

enriches the results of the audit through the best analysis of the operations

carried out by the company and the contribution of creative solutions. It is

that most of the tax problems find an ideal treatment if they combine the

accounting analysis with the legal one.

Likewise, good communication between the work team and the

company's staff is vital for the success of the audit.

This fluidity is often achieved through the use of timely

questionnaires that allow detecting weak points in the administration of taxes

and facilitate the diagnosis of those areas that involve fiscal risks.

A good part of the service involves emulating the work that

could be done by an inspection team of the Treasury.

Scope of the tax audit service Taking as a basis the taxes

administered by the General Tax Directorate (DGI), the work should include

tasks such as the review of the tax declaration for the Income Tax of Economic

Activities (IRAE) and the Wealth Tax (IP) prepared on the basis of the

company's final financial statements at the end of the financial year, its

explanatory annexes and verification of payment and presentation of the

corresponding forms within the deadlines established by the DGI, the conceptual

review of monthly obligations , including an analysis of the different types of

income, the tax rates, the calculation of the monthly advances of IRAE and IP, as

well as the correct calculation and payment of the withholdings that may

correspond to the Personal Income Tax (IRPF), Non-Resident Income Tax (IRNR)

and VAT.

Also the optimal use of tax credits, as well as the review

of all the sworn declaration forms and their annexes.

The examination of the way in which the available tax

benefits are optimized, as well as the review of the registration forms in the

tax records and the verification that the basic information of the company is

up to date, should not be left aside.

It should also be analyzed if the tax regulations are

correctly applied and if there are procedures that allow access to a rapid

regulatory update in accordance with the business activity of the company.

Once the tax assessment of the company has been determined,

recommendations should be incorporated to facilitate the rapid overcoming of

contingent situations, either through the incorporation of specific procedures,

the application of new criteria or the training of relevant personnel in the

company.

Post Your Ad Here

Comments