Why Financial Institutions Should Focus More on Cash Flow Lending

Maybe you’re a bank or a credit union or an alternative lender who has a great reputation and thousands of satisfied customers. Maybe you consider historical data such as credit score, annual revenue, and business history to determine the creditworthiness of your borrowers. Or, maybe you offer collateral-based loans to reduce your credit risk.

Even with these key areas checked off the financial-institution-success list, there are two important things needed to improve your lending decisions - lending, and your borrowers’ cash flow picture that will help you lend money to them.

In this digital lending era, every bank and non-banking financial institution across the world is realizing the importance of cash-flow lending. Even in India, many banks have already started providing loans based on a business’ future cash flow position. Recently, the RBI governor said at a webinar that "To improve the credit to gross domestic product (GDP) ratio, access to credit and cost of credit need to be addressed by lesser reliance on collateral security and greater cash-flow based lending,"

What is Cash Flow?

Whether a small business plan to obtain funding or just want to manage their business as effectively as possible, cash flow is critical.

Cash flow is the net amount of cash that is moving in and out of a business in a particular time period. From a lending perspective, cash flow represents the total net amount of cash available to the business for covering business expenses, as well as growing the business assets.

A cash flow tells a lender how much debt the business can successfully handle and how much cash flow is left to be reinvested into the business.

What is Cash Flow Lending?

Cash flow lending is the type of lending in which a lender provides loans to small businesses based on their cash flow. It allows financial institutions to lend money on the projected future cash flow of a business. This means a business borrows money from expected revenue they anticipate they will receive in the future.

Whether a business needs working capital to fund operating expenses or acquire another business, the loan is based on the cash flow of a borrower’s business. This type of lending doesn’t require any personal or business assets as collateral, but some or all of the cash flows used in the underwriting process are usually secured.

For example, a business that needs money to hire employees or make payroll might use cash flow finance and repay the borrowed amount on the revenues generated by the business on the future date.

Importance of Cash Flow Lending for Lenders

In a nutshell - cash flow helps lenders to determine a business's financial capacity to repay the loan.

Cash flow is important because it informs potential lenders of the business cash position and its financial capacity to repay the loan amount. In other words, cash flow tells lenders if a business will bring in enough money to cover the cost of any current debt, as well as the cost of a new loan.

To successfully get a loan, a business’ cash flow must exceed the amount needed to just pay any current financial obligations as they should be using extra money to take their business ahead without having to borrow. It’s not only the credit history, capital, collateral, capacity, and characters but also cash flow that lenders should consider when approving a loan application.

Simply, if a business’s future cash flow position indicates that a business won’t be able to repay the loan, then there’s no deal. Poor cash flow is one of the biggest reasons why most small businesses fail so it must be one of the major factors to consider when approving a small business loan.

Accurate and Real-Time Cash Flow Predictive Data is Essential for Lending

Today, there are many newest and most interesting attempts to use technology in the lending process including cash flow predictive data.

Cash flow data doesn’t just help small business owners visualize how money is moving in and out of a borrowers’ business but also helps lenders to determine the creditworthiness of business owners, particularly for those without credit histories.

For lenders, financing is all about risk. The more proof of creditworthiness the borrower has, the lesser risk for the lender. Cash flow predictive data helps lenders get the full picture of a business's past, present, and future finances. It helps them visualize where a business is standing in terms of financing, how well it’s managing existing repayments, and how much new financing it can afford.

From the past few years, cash flow data and emerging financial technologies are transforming business lending. From artificial intelligence to machine learning to blockchain technology, several futuristic technologies are being used to determine creditworthiness, streamline the loan process, and improve the customer experience.

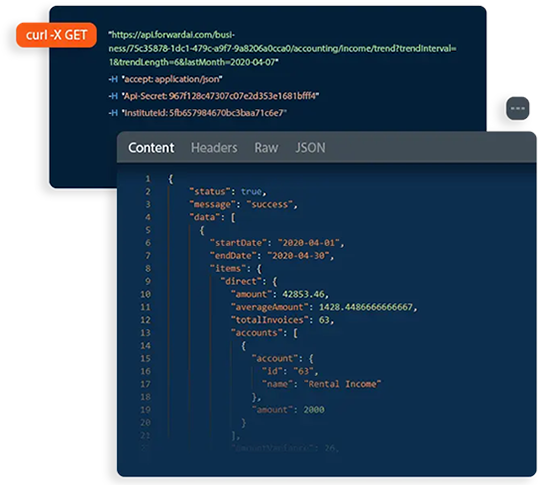

Moreover, many FinTech firms are offering forward-looking data APIs for lenders that deliver the most robust suite of cash flow data based on hundreds of data points for small business lending. Data has been the biggest problem in lending. Cash flow data provides measurable future financial situations of SMEs and helps lenders better assess their borrowers’ creditworthiness.

In particular, cash flow predictive data helps lenders in the following ways:

●Predict a business’ future

financial health, market behaviors, trends, and performances

●Estimate the money a company is

expecting to come in and out of its business.

● See past, present, and future

cash flow behavior of a company

●Check how a business is spending

its money and whether or not its expenses are sustainable.

●See how different situations may affect a business cash flow in the future

Cash flow

data is the most valuable and powerful fuel that can run the massive lending

industry in the 21st century. Having the perfect blend of historical, real-time

accounting, and cash flow data will help lenders better determine small

business owners’ creditworthiness and make smarter lending decisions.

Post Your Ad Here

Comments