What Are Medigap Plans?

People living within the country tend to face a large number of healthcare-related issues. Some of these issues are covered by the government offered insurance and healthcare plan while others are not. It would be financially impossible for a government to pay for all and any healthcare issue that its citizens face. This leaves room for private insurance companies to fill in the gap and offer healthcare supplement plans. One such healthcare plan is the Medigap.

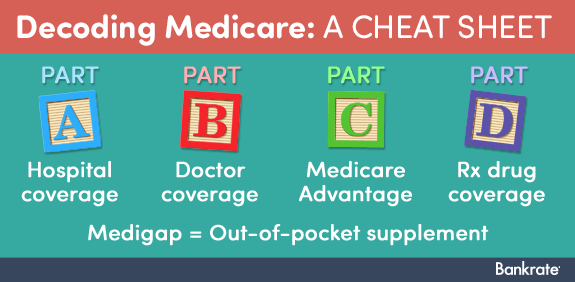

The Medigap insurance is a health insurance plan which you would have to purchase from any private insurance company in order to cover up any healthcare costs which are not being covered by the original Medicare Plan. This includes deductibles, copayments, and healthcare costs in case you travel out of the United States. However, these policies do not cover any sort of long term care, eye or dental care, eyeglasses, aids for hearing, and personal nurses. Some of these Medigap Plans do not even cover prescriptions for drugs.

About policy

This policy only covers one person, for the monthly premium that is being paid by you. If you want to have a Medigap policy for your spouse or family members, you would have to buy each one of them a separate premium.

Who is eligible?

Also, these policies are only available to those individuals who already have Medicare Part A and B. Medicare Part A is responsible for covering up the cost of hospital services, whereas Part b covers up those costs related to services of doctors. However, if you have a Medicare Advantage plan, you cannot be entitled to get a Medigap Plan. A standard Medigap Plan policy is labeled from A through N, each one of these plans and policies offers different sort of healthcare coverage.

A monthly premium is paid for the Medigap plan along with your Medicare Part B premium. Your age, location, insurance company, and the plan you have selected, have an impact on the cost of your plan. Paying your premiums on time would ensure that your policy is renewed every time. The only time it might face issues is if you have any sort of a health issue which is preexisting.

You can even apply for less expensive plans, but it would result in fewer benefits and higher costs that you would have to cover individually. If you want to drop your Medigap policy at any time you would have to think it through, as you might not get it back.

Post Your Ad Here

Comments