Quarterly Return Monthly Payment (QRMP) Scheme

Introduction.

The GST council

has introduced the QRMP scheme in the 42nd GST Council Meeting dated

October 5, 2020. As denoted by its name, QRMP Scheme is a scheme to file the return

quarterly but making payment on monthly basis w.e.f. January 1, 2021.

Meaning.

The Central

Board of Indirect Taxes and Customs (CBIC) introduced QRMP scheme under GST for

the taxpayers having aggregate turnover up to Rs. 5

crores in the current and previous FY w.e.f. January 1, 2021.

Presently, GSTR-3B return is furnished monthly, but under QRMP scheme, to bring

ease for small taxpayers, they will be filing Form GSTR-3B return quarterly and

pay tax every month either by self-assessment of monthly liability or 35% of

net cash liability of previous filed Form GSTR-3B of the quarter, starting from

January-March 2021.

For example, a

registered taxpayer having annual aggregate turnover up to Rs. 5 crores in

preceding FY and has filed return in Form GSTR-3B for the period June 2021 by

the last day of the first month of next quarter, i.e. by July 31, 2021.

It is an optional

scheme, so accordingly, the taxpayers can opt-in for the scheme or may even not

opt it and continue with their monthly filing of GSTR-3B.

Eligibility.

As per

Notification No. 84/2020- Central Tax, dated November 10, 2020, a registered

person who is required to furnish a return FORM GSTR-3B, and who has an

aggregate turnover of up to Rs. 5 crores in the preceding FY, is eligible for

the QRMP Scheme.

Procedure.

1.

Login at www.gst.gov.in using your

username and password.

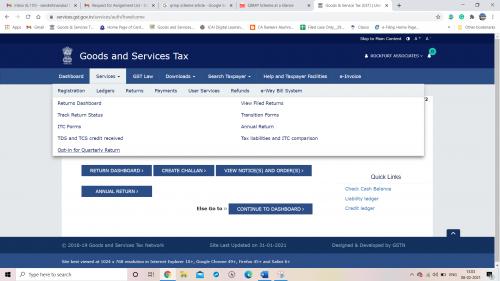

2. Click on Services > Returns > Opt-in for Quarterly Return.

Taxpayers can avail the scheme GSTIN-wise, i.e. some GSTINs for a PAN can opt-in, and others can opt-out.

Migration of

Existing Taxpayers.

For the period

Jan-Mar 2021, all the registered taxpayers having annual aggregate turnover in

the FY 2019-20 up to Rs. 5 crores and has not exceeded Rs. 5 crores turnover in

the current FY 2020-21 as well and have furnished the return in Form GSTR-3B

for October 2020 by November 30, 2020, will be migrated by default to QRMP

scheme by GST software.

The existing

taxpayers shall be migrated to the QRMP scheme based on the following annual

aggregate turnover criteria.

|

S. No. |

Class of taxpayers |

Return Option |

|

1. |

Taxpayers having turnover up to

Rs. 5 crores in the preceding FY and have furnished GSTR-1 quarterly in the CFY. |

Quarterly |

|

2. |

Taxpayers having turnover up to

Rs. 5 crores in the preceding FY and have furnished GSTR-1 monthly in the CFY. |

Monthly |

|

3. |

Taxpayers having turnover more

than Rs. 1.5 crores and up to Rs. 5 crores in the preceding FY |

Quarterly |

Invoice

Furnishing Facility (IFF)

The registered

persons opting for this QRMP Scheme would be required to furnish the details of

an outward supply in return FORM GSTR-1 quarterly. For first and second

month of a quarter, the registered person will have to furnish the details of the

outward supplies to registered person, between the 1st day of the succeeding

month till the 13th day of succeeding month. The outward supplies shall not

exceed the Rs. 50 lacs in each month.

It is pertinent

to note that after 13th of the month, this facility for furnishing IFF for a

previous month shall not be available.

A feature to

continuously upload the invoices would be provided for the registered persons to

save the invoices in the IFF from the 1st day of the month till the 13th day of the succeeding month. The

facility to furnish details of invoices in IFF has been provided to allow

details of such supplies to be duly-reflected in the GSTR-2A and 2B

of the recipient.

The afore-said

facility is not mandatory and is an optional facility made available to the

registered persons under the QRMP Scheme.

Payment of Tax.

The registered

persons under this QRMP Scheme shall be

required to pay the tax due in each of first two months of the quarter by

depositing the due amount FORM PMT-06 respectively by 25th of the succeeding

month.

While

generating challan, the taxpayers should select "Monthly payment for

quarterly taxpayer" as the reason for generating the challan.

There are two

options for the monthly payment of tax during the first two months of a

quarter.

1.

Fixed Sum Method:

A new facility

has been made available on the GSTN portal for generation of pre-filled challan

in FORM PMT-06. The aforesaid challan shall be generated for the following

amount:

|

S. No. |

Particulars |

Tax required to be paid in the first two months of

the quarter |

|

1 |

Taxpayer had filed GSTR-3B of the previous quarter

on a quarterly basis. |

35% of the tax paid (CGST / SGST/ UTGST/ IGST/ Cess)

in the form of cash |

|

2 |

Taxpayer had filed GSTR-3B of the previous quarter

on monthly basis. |

Equal to tax paid in cash in the last month of the

immediately preceding quarter |

2.

Self-Assessment Method:

-

The concerned person can pay the due tax by

considering tax liability on inward and outward supplies and ITC available in

FORM PMT-06.

-

The taxpayer needs to pay interest @ 18% on the net

tax liability which is unpaid or is paid beyond the due date for each of

the first two months of the quarter, i.e., in case of FORM GST PMT-06 if filed

after 25th of the following month.

Post Your Ad Here

Comments