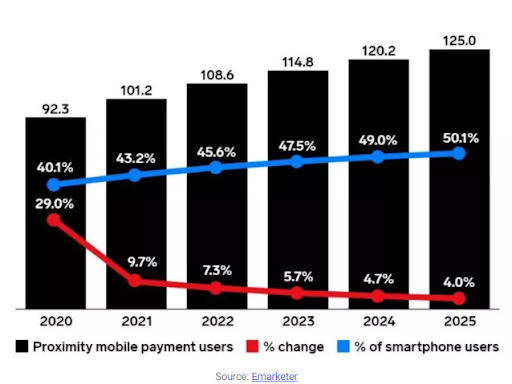

- According to Visa, Tap-To-Pay transactions grew by 30% over the past years.

- Nearly 50% of US shoppers say they won’t shop at a store that doesn’t offer a cashless way to shop.

Every business, whether offline or online, needs a payment processor and payment processing services to cater to the changing behavior of consumers. Besides ensuring the transactions are carried out seamlessly, it also improves customer experience and business reputation.

Since payment processing directly impacts your revenue, making informed decisions is crucial, especially selecting the right payment processors. After all, the payment processor you choose affects everything from your potential to collect online payments, to your customer service, to your business’s bottom line.

Choosing the one payment processor that’s a good fit for your business may sound an uphill task. But, considering the main things like fee structure, PCI compliance, and excellent customer support, it’s simple as ABC.

Before we dive deep into understanding the nitty-gritty of choosing the right payment processors, it’s important to have a quick rundown of where it all started – “Payment Processing Services.”

In simple terms, payment processing is providing a person, indirectly or directly, different means to charge or debit bank accounts through the use of any payment mechanism.

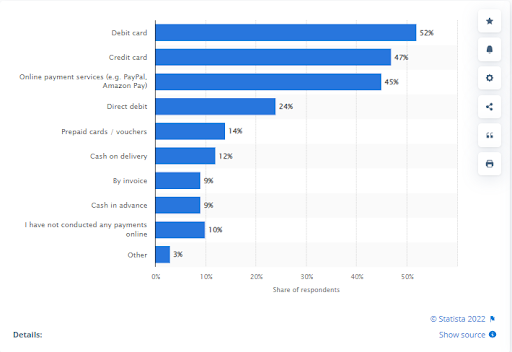

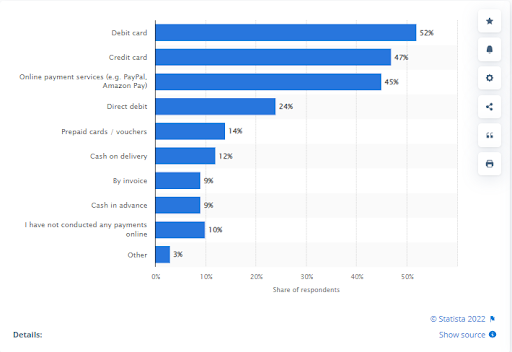

Payment processing is not just about credit or debit cards, it’s much more than that. Though debit and credit cards are the most popular payment method at this time, more options to accept payments are cementing their footstep in the hierarchy, like contactless, mobile and online payments.

Therefore, offering consumers more efficient ways to pay for goods is a key objective for all modern business owners.

To start, let’s first review what and how payment processing work, including terms that specifically relate to your business.

Introduction to Payment Processing:

To a naked eye, the payment processing might seem as simple as a credit or debit card tap, swipe or a dip, merely taking a few seconds. However, there’s more than that. It involves several steps and players, like:

- Customers

- Merchant/Business

- A payment processor

- Payment gateway

- Bank, credit or debit company

- Business bank or merchant accounts

Who are the Main Players in Processing Payments?

To simply put, in debit or credit card processing, whether online, through phone sales, or even in person, there are three main players:

On one side is you, the business owner or merchant, while on the other is your customer. And, in between lies the technology that bridges the two of you.

#Player 1: You, The Merchant

To accept credit and debit card transactions from online customers, you need to partner with some key players. As a business owner, you’ll likely need a merchant bank (also termed as the acquirer) that accepts payments on your behalf and deposits them into the provided merchant account.

#Player 2: Your Customer

For your customer to pay for the services and goods used, they need a credit or a debit card. The bank that approves them for the card payments and credits them the cash to pay you is known as an issuing bank.

#Player 3: The Technology

Between lies the two technologies that allow you and your customer to make a transaction.

First is the payment gateway, a software that links your website shopping cart to the processing network. Next comes the payment processors (or merchant service), which does all the leg work like moving the transaction through the processing network, working with the bank, sending a billing statement, doing debit or credit card processing, etc.

- The final outcome is a customer who successfully makes a purchase without cash – along with a business that completes a sale.

Some Key Payment Processing Stats On How US Customers Will Be Paying For Goods and Services Moving Forward

Before you can decide which payment processing method is right for you, it’s better to know what market stats say about it.

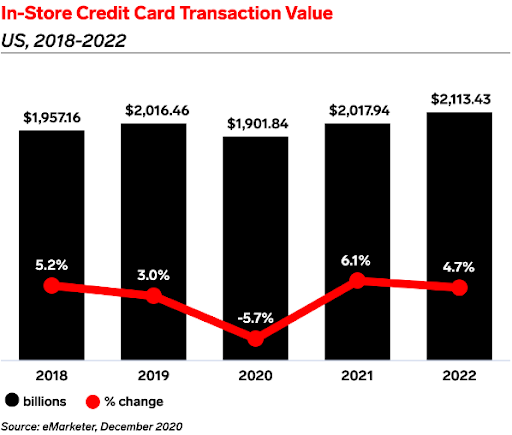

1. Credit Card Payment Processing

Credit card processing is a system through which data from the customer’s credit card is transmitted for approving a dollar transaction from their bank account to the merchant account.

While there was a dip in in-store credit card transactions during the pandemic, Insider Intelligence predicted that the value would reach $2, 223.43 in 2022.

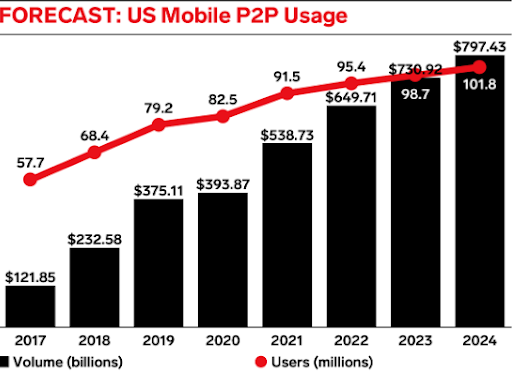

2. Online Payment Processing

Online payment processing links a website with a payment processor to connect a merchant account to a credit and debit card issuer. Furthermore, merchant accounts can set up recurring payments, accept or decline transactions according to pre-set parameters, and process payments made with foreign currency.

Furthermore, the epidemic accelerated the adoption of mobile payment platforms, as Americans sought out retailers offering contactless services. As a result, users, as well as transaction value growth, have accelerated.

3. ACH Payment Processing

ACH (Automated Clearing House) is a network used to route payments electronically between banks across the United States. Typically, there are two types of ACH payments:

Credit ACH Payments

Debit ACH Payments

Conventionally, ACH was developed as a way for banks to process paper checks digitally. But, since it has become digitally reliant, with online ACH including 27.9% of transactions by volume in the third Quarter of 2020, as per the NACHA (National Automated Clearing House Association) ACH is growing not only in segments like disbursements, bill pay, and direct deposit, but also for digital P2P transactions and online transfers.

To put in all, ACH is emerging, not just in check-based segments like bill pay, disbursements, and direct deposits, but also for online and digital P2P transactions.

4. Merchant Payment Processing

Merchant payment providers let merchants accept credit and debit cards and all other forms of payment from consumers easily. While merchant acquirers allow payment transactions, merchant payment processors are responsible for securely transmitting data related to those transactions and offering several degrees of back-office support.

For example, PayPal growth amid the pandemic witnessed an unprecedented rise as merchants relied on the firm to facilitate transactions. But, as of August 2021, PayPal changed its fee structure, making merchants pay $3.98 in fees for a $100 transaction, compared to $3.20 before.

This change made merchants think of leaving PayPal and switching to reliable payment service providers like GETTRX, which offer their own processing services.

- The best option significantly depends on your business sales volume and payment accepting method.

Now, you would think, “What happens when you process a payment?” So, let’s uncover the answer!

Comments