Can I clear out my QuickBooks and start over?

Fortunately, QuickBooks provides users with the ability to reset their data and start fresh. This process, known as "clearing out" or "starting over" in QuickBooks, allows you to essentially wipe the slate clean and begin with a new, blank company file. By doing so, you can ensure that your financial records accurately reflect your current business operations, making it easier to make informed decisions and maintain accurate financial reporting.

It's important to note that clearing out your QuickBooks data is a significant undertaking and should not be taken lightly. The process is irreversible, meaning that once you've cleared out your data, you cannot go back to the previous version. Therefore, it's crucial to carefully consider the reasons for wanting to clear out your QuickBooks and ensure that you have a solid plan in place before proceeding.

Reasons for wanting to clear out QuickBooks and start over

There are several reasons why a business owner or self-employed professional might want to clear out their QuickBooks and start over. One of the most common reasons is the accumulation of outdated or irrelevant information in the company file. Over time, as a business grows and evolves, the data in QuickBooks can become cluttered with old invoices, bills, and transactions that no longer serve any purpose.

Another reason for wanting to clear out QuickBooks is the need for a fresh start, particularly at the beginning of a new fiscal year. Some business owners prefer to start each year with a clean slate, allowing them to track income, expenses, and other financial data more effectively.

In some cases, businesses may also want to clear out their QuickBooks data due to the presence of too many errors or mistakes. Over time, it's easy for incorrect transactions, misclassified accounts, or other data entry errors to accumulate in the company file. When these errors become too numerous or too complex to fix, clearing out the data and starting over can be the best solution.

It is essential to remember the reason for "QuickBooks requires that you reboot loop" can be conflicts with other software or services running on your system, which may interfere with QuickBooks' ability to start properly.

Steps to clear out QuickBooks and start over

If you've carefully considered the risks and alternatives and have decided that clearing out your QuickBooks data and starting over is the best course of action, the process typically involves the following steps:

Backing up and saving important data before clearing out QuickBooks

Before you begin the process of clearing out your QuickBooks data, it's crucial to create a backup of your existing company file. This will ensure that you have a copy of your historical financial information in case you need to refer to it in the future or if you decide to revert to the previous version at a later date.

In addition to backing up your company file, you may also want to export or save any important documents, reports, or other information that you may need to reference or use in the future. This could include invoices, bills, payroll records, or tax-related documents.

Setting up a new QuickBooks company file

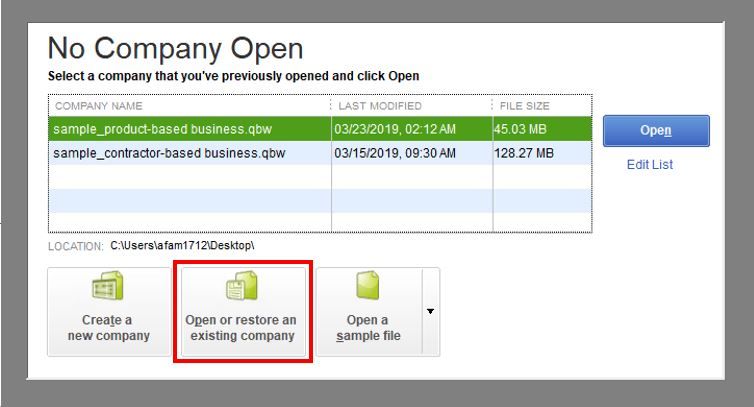

Once you've backed up your existing data, the next step is to create a new QuickBooks company file. This can be done by launching QuickBooks and selecting the "Create a new company" option. You'll then be prompted to enter basic information about your business, such as your company name, industry, and tax information.

During the setup process, you'll also have the opportunity to customize various settings and preferences for your new QuickBooks file. This includes selecting the appropriate accounting method (cash or accrual), setting up your chart of accounts, and configuring any other preferences or settings that are specific to your business.

If you have any existing data or information that you want to include in your new QuickBooks file, such as customer or vendor records, you can typically import this data directly into the new company file.

Importing or re-entering necessary data into the new QuickBooks file

Once your new QuickBooks company file is set up, you'll need to begin the process of importing or re-entering any necessary data that you want to include in your fresh start. This may include customer and vendor information, outstanding invoices and bills, inventory records, and any other financial data that is critical to your business operations.

Depending on the complexity of your business and the volume of data you need to transfer, this process can be time-consuming and may require some careful planning and organization. It's important to work methodically and ensure that you're accurately entering or importing all of the necessary information to avoid any errors or discrepancies in your new QuickBooks file.

If you have the option to import data from your previous QuickBooks file or from other sources, this can help streamline the process and reduce the risk of manual data entry errors.

Updating settings and preferences in the new QuickBooks file

In addition to importing or re-entering your necessary data, you'll also need to review and update the various settings and preferences in your new QuickBooks company file. This may include configuring your chart of accounts, setting up your sales tax rates, customizing your invoices and other forms, and adjusting any other preferences or settings that are specific to your business.

As you're updating your settings and preferences, you may also want to consider any changes or updates that you want to make to your existing accounting practices or financial management strategies. This could include implementing new reporting or invoicing templates, adjusting your chart of accounts, or modifying your payment processing or expense tracking methods.

Read more:- QuickBooks for Windows Conversion Instructions

Conclusion

Clearing out your QuickBooks data and starting over can be a valuable solution for businesses that are dealing with cluttered or outdated financial records, or that simply need a fresh start for the new fiscal year. However, it's important to carefully consider the risks and potential consequences before proceeding and to explore alternative solutions that may be less disruptive to your business operations.

Post Your Ad Here

Comments