All you Need to know about CRISIL Rating

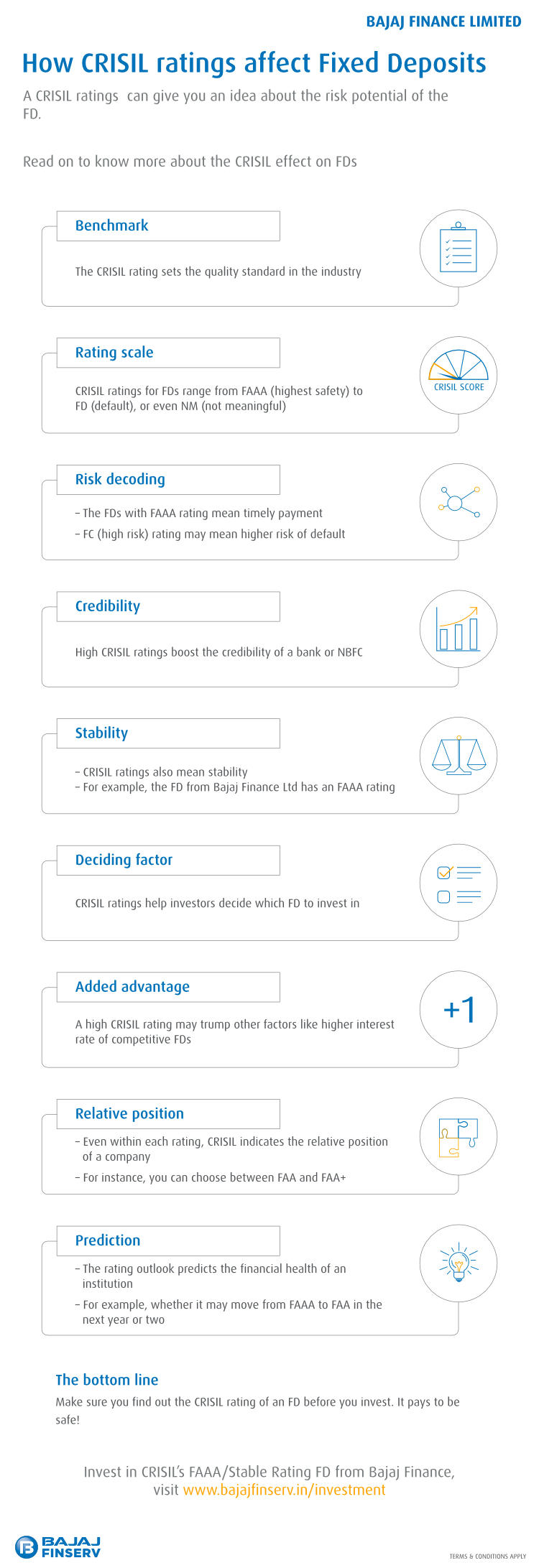

As one of the oldest credit rating agencies in India, CRISIL evaluates various investment instruments in order to help you determine the stability of each option. These investment instruments include bonds, short-term investments, and hybrid instruments.

CRISIL is important because while investing in an FD, for example, just looking for a high interest rate will not guarantee returns. It is also essential that you choose an FD that has a high CRISIL rating. This will ensure that you will get the amount as promised to you, and on time. For instance, Bajaj Finance’s Fixed Deposit offers you up to 8.40% interest with an additional 0.25% upon renewal. This FD also has CRISIL’s FAAA/Stable rating, indicating that it is a good instrument to invest in.

In order to know more about CRISIL ratings, read on.

What Factors Affect CRISIL Ratings?

CRISIL grades investments in accordance to its own standards and terms. It determines the credibility of the issuer, its financial standing, debts, and many other parameters. Based on its evaluation, it allots each investment a rating. These ratings give you an overview of how safe the instrument you are considering making an investment is. Apart from the credit profile and financial status of the issuer, here is a list of the various factors that have an effect on a financial institution’s FD’s CRISIL rating.

CRISIL considers the issuer’s liquidity

CRISIL considers the FD programme’s granularity

CRISIL factors in the renewal rates offered along with the FD

CRISIL considers the FD’s maturity profile

What is the CRISIL Rating System?

After evaluating the financial institution, its individual debt and investment offering, CRISIL rates them on a scale. The rating they give to each helps you understand how trustworthy the issuer is, and how stable an investment is likely to be. Take a look at the various CRISIL ratings and what they stand for.

FA: Adequate safety

FAA: High safety

FAAA: Highest safety

FB: Inadequate safety

FC: High risk

FD: Default

NM: Not meaningful

So, it is in your best interest that you choose an investment, be it an FD or any other instrument, that has a FAA or FAAA rating in order to minimise risk and ensure that you get the earnings as promised. A high rating indicates that your investment is in safe hands and will offer you rewards as per the terms and conditions stipulated by the financial institution.

While the above ratings were for FDs that mature after a year or more, CRISIL also uses the scale of CRISILA1+ to CRISIL A5 to rate FDs offered by banks. These ratings apply to FDs that have a maturity period of less than a year.

In this manner CRISIL uses its ratings system to help you determine the most secure options in any category of investment instruments. So, it is important that you always check CRISIL ratings before selecting investment options for your portfolio.

Post Your Ad Here

Comments