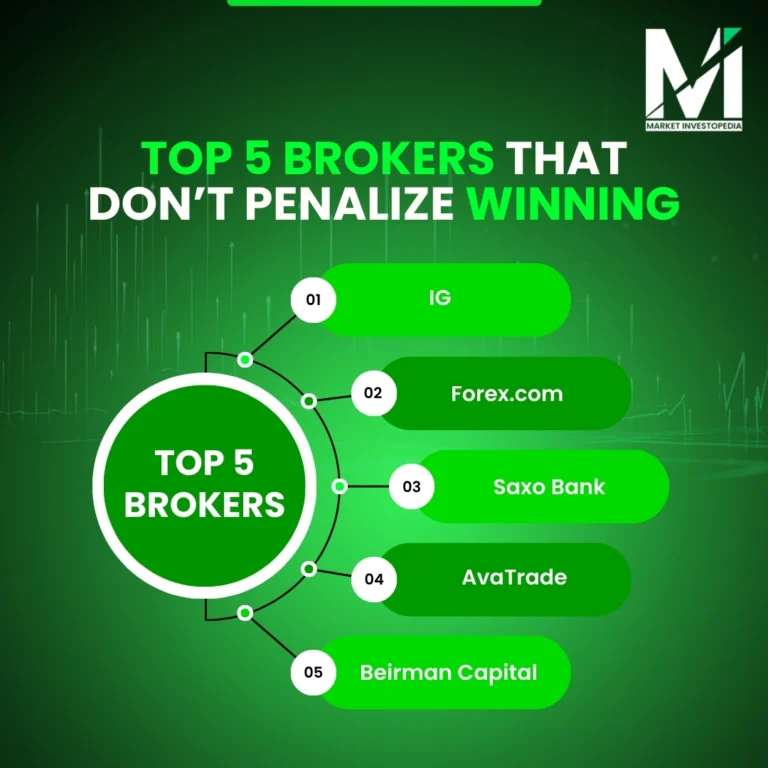

5 Brokers That Dont Penalize You for Winning

Every trader works toward one goal which is profitability. Making consistent gains is not easy and when it finally happens the last thing a trader expects is resistance from the broker. Unfortunately there have been cases where traders faced account restrictions delayed withdrawals or penalties after earning large profits.

This raises an important question. Can a broker penalize you simply for winning. More importantly how can traders protect themselves from such situations.

This article explains why some brokers penalize profitable traders and highlights five brokers known for fair trading practices.

Originally published at https://marketinvestopedia.com

Why Do Some Brokers Penalize Profitable Traders

A broker acts as an intermediary that provides access to financial markets. In a fair setup the broker earns through spreads or commissions regardless of whether a trader wins or loses.

Problems usually arise when trading terms are violated knowingly or unknowingly accounts trigger internal risk controls or brokers operate with conflict of interest models.

Some brokers use a dealing desk model where the broker takes the opposite side of the trader’s position. In such cases trader profits can directly translate into broker losses. This structure increases the risk of unfair practices like execution delays slippage manipulation or account scrutiny after large wins.

With transparent regulated brokers such situations are far less likely.

5 Brokers Known for Fair Treatment of Profitable Traders

IG

IG is widely recognized for its strong regulatory framework and transparent pricing structure. The broker offers access to thousands of global instruments and clearly displays trading costs. Client funds are kept in segregated accounts and risk management policies are openly stated. Reports of profit based penalties are extremely rare with this platform.

Forex.com

Forex.com operates under multiple financial regulators and follows strict compliance standards. The platform focuses on execution quality market access and trader education. While trading fees vary by region account handling remains consistent even for high volume or profitable traders.

Saxo Bank

Saxo Bank offers a professional trading environment backed by bank level regulation. Client protection financial transparency and capital security are core strengths of the platform. Although trading costs can be higher compared to retail brokers the risk of unfair account action is minimal due to strict oversight.

AvaTrade

AvaTrade is popular among traders who use automation copy trading or long term strategies. The broker provides strong client protection measures including negative balance protection and segregated funds. Its regulatory coverage across multiple regions adds an extra layer of trust for profitable traders.

Beirman Capital

Beirman Capital is an emerging CFD broker offering access to forex indices stocks and cryptocurrencies. The platform has gained recognition for smooth withdrawals stable execution and competitive trading conditions. Trader feedback indicates consistent account handling without profit related restrictions.

How to Avoid Issues With Brokers After Profitable Trades

Traders can reduce risk by following a few essential precautions.

- Read trading terms carefully before opening an account

- Avoid brokers with clear conflicts of interest especially non transparent dealing desks

- Choose regulated platforms licensed by recognized financial authorities

- Check real user reviews for withdrawal or account restriction complaints

- Follow platform rules strictly especially during high volume or short term trading

- A broker should facilitate market access not interfere with trading outcomes.

Final Thoughts

Brokers penalizing traders for winning is not common but it does happen usually with poorly regulated or opaque platforms. A reliable broker should focus on execution quality transparency and fair account management.

By choosing regulated brokers and understanding how different brokerage models work traders can protect their capital and trade with confidence.

Post Your Ad Here

Comments