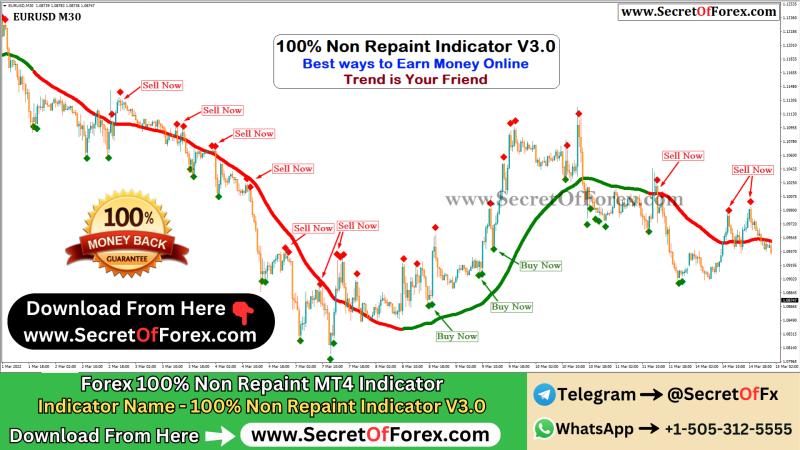

most accurate reversal indicator

The Most Accurate Reversal Indicator in Forex Trading

Reversal indicators are essential tools in forex trading, helping traders identify potential turning points in price trends. While no single indicator guarantees 100% accuracy, some stand out for their reliability in predicting reversals. This article explores the most accurate reversal indicators, their mechanics, and how traders can use them effectively.

Purchase this Powerful Indicator from here ??

Purchase Link - https://forexprostore.com/product/100-non-repaint-indicator-v2-0/

Contact Telegram - https://telegram.me/SecretOfFx

Contact WhatsApp - https://wa.me/+15053125555

Understanding Market Reversals

A market reversal occurs when the price direction of a currency pair changes. This shift can be from an uptrend to a downtrend (bearish reversal) or from a downtrend to an uptrend (bullish reversal). Reversals often occur at key support or resistance levels and can be identified using technical indicators, candlestick patterns, and price action analysis.

To accurately predict reversals, traders must differentiate them from retracements, which are temporary pullbacks in price before the trend resumes. Reversal indicators help confirm whether a price change is temporary or the start of a new trend.

Top Reversal Indicators

1. Relative Strength Index (RSI) Divergence

RSI is a momentum oscillator that measures the speed and change of price movements on a scale of 0 to 100. The most effective way to use RSI for reversals is by identifying divergences between price action and the RSI indicator.

- Bullish Reversal: Occurs when price forms lower lows while RSI forms higher lows, signaling weakening selling pressure.

- Bearish Reversal: Happens when price forms higher highs while RSI forms lower highs, indicating weakening buying pressure.

An RSI reading above 70 suggests overbought conditions, while below 30 indicates oversold conditions. However, relying solely on these thresholds can lead to false signals, so traders often combine RSI with other indicators.

2. MACD (Moving Average Convergence Divergence) Crossover & Divergence

The MACD indicator consists of two moving averages (MACD line and Signal line) and a histogram that measures momentum.

- MACD Crossover: A bullish reversal occurs when the MACD line crosses above the Signal line. A bearish reversal happens when the MACD line crosses below the Signal line.

- MACD Divergence: If price makes higher highs while MACD makes lower highs, it signals a bearish reversal. Conversely, if price makes lower lows while MACD makes higher lows, it signals a bullish reversal.

MACD is most effective when used in conjunction with trendlines and support/resistance levels.

3. Bollinger Bands Reversal Signals

Bollinger Bands consist of a middle moving average and two outer bands that measure volatility. When price touches or exceeds these bands, it can signal a potential reversal.

- Bullish Reversal: If price closes below the lower Bollinger Band and then moves back inside, it signals a reversal upward.

- Bearish Reversal: If price closes above the upper Bollinger Band and then moves back inside, it signals a downward reversal.

Traders should confirm these signals with volume analysis and other indicators to reduce false breakouts.

4. Fibonacci Retracement Levels

Fibonacci retracement levels help identify areas where price may reverse based on historical price movements. The most commonly used levels are 38.2%, 50%, and 61.8%.

- If price retraces to one of these levels and shows rejection (e.g., strong candlestick patterns or divergence with RSI/MACD), it suggests a potential reversal.

- The 61.8% retracement level is particularly significant, often acting as a strong reversal point.

Fibonacci retracements work best when combined with trendline support and resistance zones.

5. Candlestick Reversal Patterns

Candlestick patterns are powerful tools for detecting reversals. Some of the most accurate patterns include:

- Hammer & Inverted Hammer: Indicate bullish reversals after a downtrend.

- Engulfing Patterns: A bullish engulfing candle signals a reversal upward, while a bearish engulfing candle suggests a reversal downward.

- Doji & Morning/Evening Star: These patterns indicate indecision in the market and potential reversals.

Candlestick patterns should be confirmed with volume spikes or other indicators like RSI divergence.

6. Volume-Based Reversal Indicators

Volume is a crucial factor in confirming reversals. The On-Balance Volume (OBV) indicator tracks volume flow, showing whether buying or selling pressure dominates.

- Bullish Reversal: Price makes lower lows, but OBV forms higher lows, indicating strong buying pressure.

- Bearish Reversal: Price makes higher highs, but OBV forms lower highs, signaling potential selling pressure.

Volume confirmation helps filter out false signals from other indicators.

Best Practices for Using Reversal Indicators

To maximize accuracy, traders should:

- Combine Multiple Indicators – No single indicator is foolproof. Using RSI divergence with MACD crossovers or Bollinger Band signals with candlestick patterns increases reliability.

- Confirm with Price Action – Strong support and resistance levels should align with indicator signals for higher accuracy.

- Use Stop-Loss and Risk Management – Always set stop-loss levels to protect against unexpected market movements.

- Analyze Higher Timeframes – Checking the 1-hour, 4-hour, or daily chart can confirm reversal signals on lower timeframes.

- Avoid Overtrading – Wait for clear confirmations before entering a trade to reduce the chances of false reversals.

Conclusion

The most accurate reversal indicator depends on the market conditions and a trader's strategy. RSI divergence, MACD crossovers, Bollinger Bands, Fibonacci retracements, candlestick patterns, and volume analysis all provide valuable insights into potential reversals. By combining these tools and confirming signals with price action, traders can improve their accuracy and profitability in forex trading.

Post Your Ad Here

Comments