Which Are the 5 Best Gold Stocks to Watch in April?

by Scarlett S. Stock Market AnalystThe world has been steadily recovering as it has discovered vaccines for the awful virus that engulfed more than 200 nations last year. The mass inoculation programmes are expedited by most of the governments, and markets are witnessing gradual recovery.

Experts believe that with the overall recovery in global stock markets and a strong dollar, the gold has seen a correction in its prices compared to last year, where it breached a level of US$ 2,000 per ounce and created a life-time record high.

Veteran investors know the fact that Gold tends to surge during crucial phases and downturns of the economy as it is considered ‘a store of value’. In simpler terms, Gold has an inverse correlation with the state of the economy. Therefore, smart investors take a considerable amount of exposure in Gold for unprecedented and unforeseen circumstances.

As the markets are recovering, Gold prices are witnessing a correction. Hence, it could be the right time to take an exposure on the precious metal. Those who are worried about the custody and storage costs of Gold might consider taking indirect exposure in the precious metal by investing in Gold stocks that tend to resonate with the actual Gold prices most of the time.

Also read: How to Invest in Gold and Which Gold Stocks to Look at This Year

In this article, we shall put our lens through 5 Gold stocks listed on the LSE that investors have on their radar.

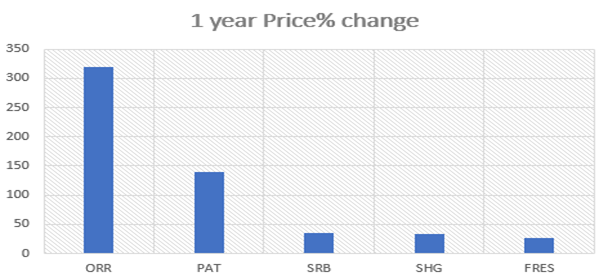

(Data Source: LSE) Copyright © 2021 Kalkine Media Pty Ltd.

- Oriole Resources Plc (LON: ORR)

UK-based precious metal miner Oriole Resources (market cap: £14.45 million) has gold exploration assets in the European and African region. The company emphasised on cost optimisation during the first half of FY2020 that helped it with substantial improvement in its profitability. During the first half of 2020, the gold mining company recorded a profit after tax of £320,000 (H1 2019: loss for the period of £748,000). Since the company is still in a nascent stage, it relies on cash and grants to manage its finances. Shares of Oriole Resources have delivered a price return of 320 per cent in past one year.

- Panthera Resources Plc (LON: PAT)

Panthera Resources (market cap: £9.54 million) is a gold exploration company with mining assets in India & Africa. According to industry veterans, Panthera is on track to breakeven and could churn a profit of US$2.2 million in 2021. Despite the metals & mining business being capital intensive, Panthera’s balance sheet is debt free. After striking positive results from a recently concluded soil sampling programme, the company has expedited the next phase of Gold exploration at its Bassala gold project in Mali. Shares of Panthera Resources have delivered a price return of 140 per cent in the past one year.

- Serabi Gold Plc (LON: SRB)

Precious metal miner Serabi Gold (market cap: £51.50 million) has gold exploration assets in the Brazilian region. Serabi Gold reported an increase in production during the fourth quarter of 2020 in contrast to the previous quarter, following the resumption of regional exploration and mining activities. Hence, production from the current Palito Complex operations is now expected to be in between 33,000 to 36,000 ounces during the fiscal year 2021 and might further go up to 45,000 ounces in 2022. SRB shares have delivered a price return of over 35 per cent in the past one year.

- Shanta Gold Ltd (LON: SHG)

FTSE AIM All-Share listed gold miner Shanta Gold Ltd (market cap: £124.45 million) is a relatively new business in the mining sector, having gold exploration assets in Tanzania. The company has successfully operated in East Africa for nearly 20 years, and the recent acquisition of the West Kenya Project will extend the geographical footprint. The group has a strong balance sheet along with strong margins, which could provide substantial flexibility to act swiftly on growth opportunities and create value for all its stakeholders. Last week, the Company proposed a final dividend of 0.10 pence per share for 2020. SHG shares have delivered a price return of 33 per cent in the past one year.

- Fresnillo Plc (LON: FRES)

FTSE 100-listed leading gold miner Fresnillo (market cap: £6,368.23 million) has high-quality assets, a strong balance sheet, and healthy margins. The precious metal miner has declared a final dividend of 23.5 cents per share for the FY2020. Fresnillo’s EBITDA soared by 73.4 per cent year-on-year in 2020. The company has a robust balance sheet along with strong liquidity. With a strong pipeline of new mines and projects, the long-term outlook for the company remains positive despite 2020 being a challenging year. Shares of Fresnillo have delivered a price return of 26 per cent in the past one year.

First Published on Kalkine Media

Sponsor Ads

Created on Apr 6th 2021 06:01. Viewed 505 times.