When Do W2 Come Out?

Your Form W-2 affects your government and state charge filings. It's in this way basic that you get your W-2 on schedule. However, what is a W-2? When would it be a good idea for you to get it? How would you read a W-2? Also, what would it be advisable for you to do on the off chance that you discover a blunder on your W-2? Peruse on for answers.

What is a W2?

IRS Form W-2, Wage, and Tax Statement, is utilized by businesses to report workers' yearly wages/pay rates, charges retained, and other pay. see when w2s come out

Give you a W-2 on the off chance that they paid you at any rate $600 for the year

Record Copy A with the Social Security Administration

Record Copy 1 with the state or nearby assessment office, in the event that you paid state or neighborhood charges

Give you Copy B to record with your government personal assessment form

Give you Copy 2 to record with your state or neighborhood assessment form, if pertinent

Give you Copy C to hold for your records

You should be a representative to get a W-2. In case you're a self-employed entity, you ought to get a Form 1099-MISC (not a W-2) from every one of your customers that paid you, in any event, $600 for the year.

When does a W2 come out?

Your manager has until January 31 to appropriate W-2s (for the earlier year) to workers. On the off chance that the cutoff time falls on a Saturday, Sunday, or legitimate occasion, your manager must outfit W-2s by the following industry day.

Managers that give online access to W-2s must do as such by January 31. Those that don't flexibly online access must mail or hand-convey W-2s no later than January 31.

On the off chance that you don't get your W-2 by the cutoff time, let your manager know so they can resolve the issue. w2 online Form instruction.

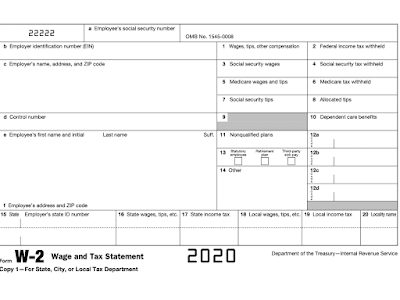

How to peruse a W-2 structure?

Despite the fact that your W-2 is basically about how much cash you earned and the measure of expenses you paid, it's likewise a nitty-gritty archive. It appears, for example, your retirement plan commitments, the sum your manager paid for your medical coverage, and the nontaxable pay you got from your boss.

Here's a breakdown of important W-2 boxes:

Box 1: Total wages — including pay rates, tips, and other pay — subject to government personal assessment. Box 1 doesn't show pre-charge conclusions or nontaxable wages.

Box 2: Federal annual expense retained from your wages.

Box 3: Wages subject to Social Security charge. This sum ought not surpass the yearly Social Security wage limit.

Box 4: Social Security charge retained from your wages.

Box 5: Wages subject to Medicare charge. No yearly pay limit applies to Medicare charge.

Box 6: Medicare charge retained from your wages. This incorporates normal Medicare charge, and if pertinent, the extra Medicare tax of 0.9% for high-pay workers.

Box 7: Tips you answered (to your manager) that were dependent upon Social Security charge. This sum is additionally reflected in Box 1 wages.

Box 8: Tips your boss allotted to you. This sum doesn’t appear in Box 1 wages.

Box 10: Dependent consideration benefits you got from your manager. On the off chance that you contributed more than the yearly pre-charge limit, the overabundance sum is available and includable in Box 1 wages.

Box 11: Taxable sums conveyed to you from your boss' non-qualified conceded remuneration plan.

Box 12: Used to convey data about different kinds of remuneration and advantages, for example, available gathering term disaster protection, elective deferrals to a 401(k) plan, Roth 401(k) commitments, reception benefits, nontaxable wiped out compensation, and cost of business supported wellbeing inclusion. The accompanying diagram clarifies what goes in Box 12, or more going with codes:

Structure W-2

Picture Source: Department of the Treasury Internal Revenue Source

Box 13: Your manager must check whichever applies:

You're a legal worker

You added to your manager's retirement plan

You got outsider wiped out compensation

Box 14: Other data your manager needs you to know, for example, state inability protection charge retained, organization fees, educational cost help installments, medical coverage premiums deducted, and uniform installments.

Box 16: Wages subject to state personal assessment.

Box 17: State personal assessment retained from your wages.

Box 18: Wages subject to neighborhood charges, for example, city or area charges.

Box 19: Local expenses retained from your wages.

Consider the possibility that there's a blunder on my W2 structure.

On the off chance that you see an error on your W-2 —, for example, inaccurate name, off base Social Security Number, wrong wages, or mistaken duties retained — let your manager know at the earliest opportunity. Contingent upon the mistake, your boss may need to give you a rectified W-2 by means of Form W2, which you would then be able to use to change your government forms if vital.

Experiencing difficulty getting your boss to address your W-2? Contact the IRS.

Post Your Ad Here

Comments