Introduction to Hong Kong Accounting Standards

This article is originated from:https://fastlanepro.hk/accounting-standards/

As the world becomes increasingly globalized, more people are engaged in the world of business than ever before. As a direct result, it has become largely recognized that it is essential for there to be general consensus on how businesses recognize and present their financial information. Accounting standards help address this issue as they offer a minimum level of transparency and understanding in how businesses recognise and present their financial information. It is now expected that all countries maintain accounting standards that provide just that – Hong Kong is no exception. In this article, we will explore what Hong Kong’s financial reporting standards are, the scope of its influence, and what SME owners should consider

1. What are the Hong Kong Accounting Standards (“HKAS”)?

The HKAS are the rules that govern the treatment of Hong Kong financial transactions and are known locally, as the Hong Kong Financial Reporting Standards (“HKFRS”). These standards serve as the fundamental principles of how companies, operating in Hong Kong, can remain compliant with their local accounting obligations.

Having been structured around the International Financial Reporting Standards, the HKAS helps ensure minimum disclosure levels for financial transactions. They are there to help recognize, measure, present disclosure requirements for general purpose financial statements. In summary, HKAS provides an overview for what is considered an “true and fair” financial statement.

2. What is the Scope of the HKAS?

According to the Hong Kong Institute of Certified Public Accountants (“HKICPA”), the HKAS are designed to apply to general purpose financial statements and other financial reporting of all profit-oriented entities.

Profit oriented entities include those that are engaged in commercial, financial and similar activities. The HKAS are not designed to apply to non-profit activities in the private sector, public sector or government.

3. What do the Hong Kong accounting standards consist of?

HKFRS has 15 financial reporting standards, 41 distinct accounting standards, as well as several other interpretations. Every standard relates to a specific topic and can range from inventory, financial statements, income taxes, cash flow statements and more.

4. Main Principles of HKAS

Accrual Basis of Accounting

Hong Kong’s accounting system is unique in that Hong Kong companies will use the accrual basis of accounting – however, cash flow statements are an exception. This means that the effects of transactions and events that result in material accounting changes, should be recognized when they occur.

Financial statements prepared on this basis, inform users not only of past transactions involving the payment and receipt of cash, but also of obligations to pay cash in the future and of resources that represent cash to be received in the future.

HKAS 1: Presentation of Financial Statements

HKAS1 specifies the overall requirements when presenting financial statements, and offers guidelines for their structure and minimum disclosure requirements in regards to its contents.

To summarize HKAS 1:

- When preparing financial statements of an entity, management shall make an assessment of the entity’s ability to continue as a going concern

- When an entity does not prepare financial statements on a going concern basis, it shall disclose this fact and explain why the financial statement was prepared in such a way

- An entity shall not offset assets and liabilities or income and expenses, unless required or permitted by a HKFRS

- An entity shall present a complete set of financial statements (including comparative information) at least once a year

HKAS 2: Inventories

HKAS 2 sets out how inventory should be treated from an accounting perspective. In Hong Kong, the main criteria is that inventories are to be recognized as an asset and at cost and that these assets should be carried forward until the related revenues are recognized.

- Inventories shall be measured at the lower of cost and net realizable value

- The cost of inventories shall comprise all costs of purchase, costs of conversion and other costs incurred in bringing the inventories to their present location and condition

- The cost of inventories shall be assigned by using the first-in, first-out or weighted average cost formula

HKAS 18: Revenue

HKAS 18 clarifies how revenue should be treated when it arises from certain types of transactions and events.

- Revenue shall be measured at the fair value of the consideration received or receivable

- Revenue from the sale of goods shall be recognized when all the following conditions have been satisfied:

- The entity transfers to the buyer the significant risks and rewards of ownership of the goods

- The entity retains neither continuing managerial involvement to the degree usually associated with ownership nor effective control over the goods sold

- The amount of revenue can be measured reliably

- It is probable that the economic benefits associated with the transaction with flow to the entity

- The costs incurred or to be incurred in respect of the transaction can be reliability measured

For a complete set of the HKFRS, please refer to HKICPA’s HKFRS handbook.

5. HKFRS for SMEs

The HKICPA has also issued a reporting framework designed with SMEs in mind. These are known as the SME Financial Reporting Framework (“SME-FRF”) and the Financial Reporting Standard (“SME-FRS”). These standards were introduced to simplify the financial reporting procedure for SMEs.

SMEs Qualifying for Reporting Exemptions in Hong Kong

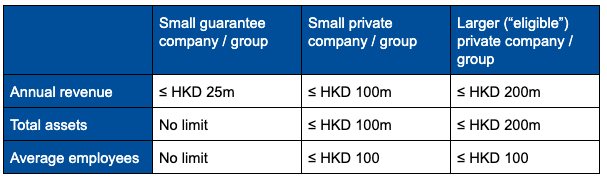

A company incorporated in Hong Kong qualifies for reporting under SME-FRF and SME-FRS if it satisfies the following reporting exemption criteria:

- They fall within the size tests; and

- In the case of larger private companies, they obtain at least 75% shareholder approval, with none objecting

Hong Kong companies that are limited by guarantee, and private companies may qualify for the optional reporting exemptions. SMEs cannot qualify for the reporting exemptions if:

- The SME is an institution authorized under the Banking Ordinance;

- The entity is licensed to perform regulated business activities under Part V of the Securities and Futures Ordinance

- The company carries on any insurance business, excluding a business carried out by an agent

- The company accepts loans at interest or repayable at a premium as part of business or trade. This excludes terms involving debentures and securities

Under SME-FRF and SME-FRS, Hong Kong companies are exempt from the requirement to give a true and fair view of their financial transactions. With simplified financial statements, SMEs:

- May prepare their financial statements under SME-FRF and SME-FRS< rather than under HKFRS

- This means that SMEs financial statements are prepared on a simplified historical cost basis, and do not include any assets or liabilities at fair value, or deferred tax

- The disclosure notes also contain less information on the reporting entity’s affairs compared to full financial statements

Conclusion

As accounting standards are used to provide a general understanding of how a business is fairing, understanding your local accounting standards and following them is essential. By not following these standards, a business is at risk of not properly presenting it to their stakeholders. For questions about how HKAS will impact your business, please contact the Fastlane Group for assistance!

Post Your Ad Here

Comments