Start-up funding or Start-up capital is money required to initiate and run the business. The need for funding for small business start ups happens for many reasons like manufacturing, product development, infrastructure, team hiring, marketing and sales, office space, license, and certification. Businessmen need to be clear why they are augmenting the funds. Seed funding for a startups can be possible from different sources. The entrepreneur should contact the best Venture capital firms with detailed business and financial plans. Careful planning and a proper futuristic approach are required; 90% of startups shut down their shutters within one year. Every start-up should have a vision, and it requires a handsome amount of funds to fulfill. India is the 3rd largest ecosystem for start-up in the world. Indian start-up industry gets a loan from private as well as government sector. No doubt, ideas, and passion are the fundamental elements for every start-up, but without financial investments, no business can grow. Evolving technology, increasing demands for customers, and big networks always promote start-ups.

Process of start-up funding

Before entrepreneurs start thinking about the funding for their small business startups, they should prepare detailed long term planning of their business. No investors like to seed funding for startups if they don’t see a proper plan. Investors would like to see the financial projection of the start ups. Every startup should have information like entrepreneur introduction, company long term, and short term goals, SWOT analysis, competitor analysis, different roles of the team members or employees, and detailed financial projection in their business plan. Futuristic entrepreneurs should visit their bank for funding for small business startups and take help from friends and family members. There is venture capitalist always ready to invest money in good start ups.

Startups- different state policies in India

Many initiatives have been taken by different states of India to accelerate funding for small business startups in various states. Many ventures have been given state-funded grants, chances to develop a network with angel investors, and loans with less interest. Karnataka started the “Idea2PoC scheme” for start ups and can grant up to Rs. 50 lakh to the pioneering entrepreneurs. Gujarat provides an amount of Rs. 10 lakh as seed funding for start-ups through a capital fund scheme for product development and marketing assistance. Jammu and Kashmir have provided a seed funding capital scheme of Rs. 10 lakh to kick start the venture. Rajasthan has also initiated a start-up policy for visionary entrepreneurs of its state.

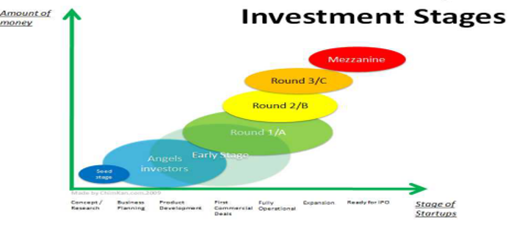

Rounds of start-up funding

* Bootstrapping: Before starting the business, the entrepreneur has to decide how much to invest from his own pocket. He may take help from his friends or family members. He can save on a substantial interest rate, which banks could charge otherwise.

* Seed funding for startups: When an enterprise has planted itself, it raises money from the best Venture capital firms. This amount is used for market research and product development. At this stage, angel investors are regular investors.

* Series A funding: In this stage, startups are expected to be ready for the future development of the product or service and need to raise money.

* Series B funding: In this stage, the venture needs expansion to gain more customers and build a strong team and require funds accordingly.

* Series C funding: At this stage, the enterprise is ready to acquire other businesses and develop new products. At this point, the venture is prepared for Series C funding and plans to go out of the home country to obtain new markets.

* Series D funding: Most of the enterprises go up to Series C funding. However, some companies move forward to Series D funding. Before going public, the start-up has discovered new opportunities for expansion at this stage.

* Series E funding: Few companies move to this stage. When they usually fail to meet the expectation from the previous steps, they reach this stage. Also, if the company requires some more help before going public, they get to this stage of funding.

* Initial Public Offering: When start-ups decide to raise funds through the public by selling its shares, this stage is known as IPO ( Initial Public Offering).

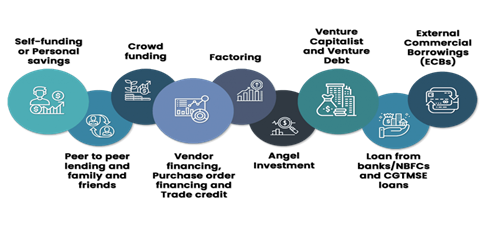

Types of start-up funding

* Personal savings and credit: This is the substantial portion of start-up capital. This is the most approachable form of funding for small business start-ups, as the entrepreneur doesn’t need to rely on anyone else.

* Friends and relatives: Many venture owner turns to their family and relatives for funding. Entrepreneurs don’t need to convince them as hard as to venture capitalists and banks to seed funding for start-ups.

* Angel Investors: They are the individuals who have a pocket to invest. Angel investors don’t interfere in the management decisions but are interested in the return of their investments.

* Venture Capital: Even investment from the best Venture capital firms is of high risk but has good potential for exponential growth. If entrepreneurs are scaling for a big goal, gaining funds from the best Venture capital firms is a good option.

* Banks: Taking small loans is uncomplicated from banks by entrepreneurs. When some income is coming in, this type of funding is the best choice. Retaining full ownership while this funding is more possible.

* Crowdfunding: In this method, the fund is raised by different individuals like friends, family, investors, and customers. This approach is more like the collective efforts of a large number of individuals.

* Accelerators: They offer funding, mentorship, and other guidance also.

* Grants: There are three types of government grants- federal, state, and local. Federal provides massive grants. State grants are a little lesser than Federal. Government grants from local authorities are tiny but easy to get.

Companies funding start-ups

Since 2015, over 650 companies have shown interest in funding start-ups. These companies are known as Venture capitalists. Venture capitalists have to be recognized by SEBI. Some of the best Venture capital firms are the following:

* Sequoia Capital: It is based in California. This company is specialized in the early and growth stage. The investment domain of this company is healthcare, technology, the financial sector, and the internet. They have funded just dial, Zomato, etc.

* Kalaari Capital: This company invest in technology and small startups at early and seed stage. They have settled seed funding for start-ups like Snapdeal, Myntra, Scoop Whoop, etc.

* Accel partners: This is one of the oldest and best Venture capital firms in India. They invest in mobile, software, infrastructure, and the internet. They have invested in companies like Flipkart, Myntra, Book My Show, etc.

* Blume Ventures: It has invested in around 60 start-ups like Cashify, Healthify Me, Taxi for sure, etc. Their investment domain is telecommunication, research, and development, software sectors, etc.

* Venture East: It has performed seed funding for start-ups like eYantra, Portea, etc. They focus their investment in areas like Pharmaceuticals, Retail, Digital Healthcare, etc.

Many more Venture capital firms are SAIF partners, Matrix partners, 3one4 Capital, Helion Venture Partners, Nexus Venture partners, etc.

Statistics show many ventures fail due to improper funding. With the right planning, proper funds can be accessed. Colitco ( https://colitco.com/) is an online hub and content driven platform. Colitco brings inspiring stories related to Startups, Angel Investors, Venture capitalists, Private Equity, and much more. Colitco provides investors start-up funding scenario. Investors learn about different startups that are actively looking for growth funds through various mediums from Colitco. Colitco has a pool of Angel investors, private equities, and venture capitalists. For details, please drop us a mail at info@colitco.com.

Comments