Employee Retention Tax Credit Application: Quickly Check Your Eligibility Online

by DAVIS BROWN PRC Agency

Have you received any financial support during the health crisis? How has your business survived to date? If you need a boost before Christmas, have you considered applying for the Employee Retention Tax Credit program? The program is open to business owners across America - even if you have already applied for PPP. Contact the team to check your eligibility today!

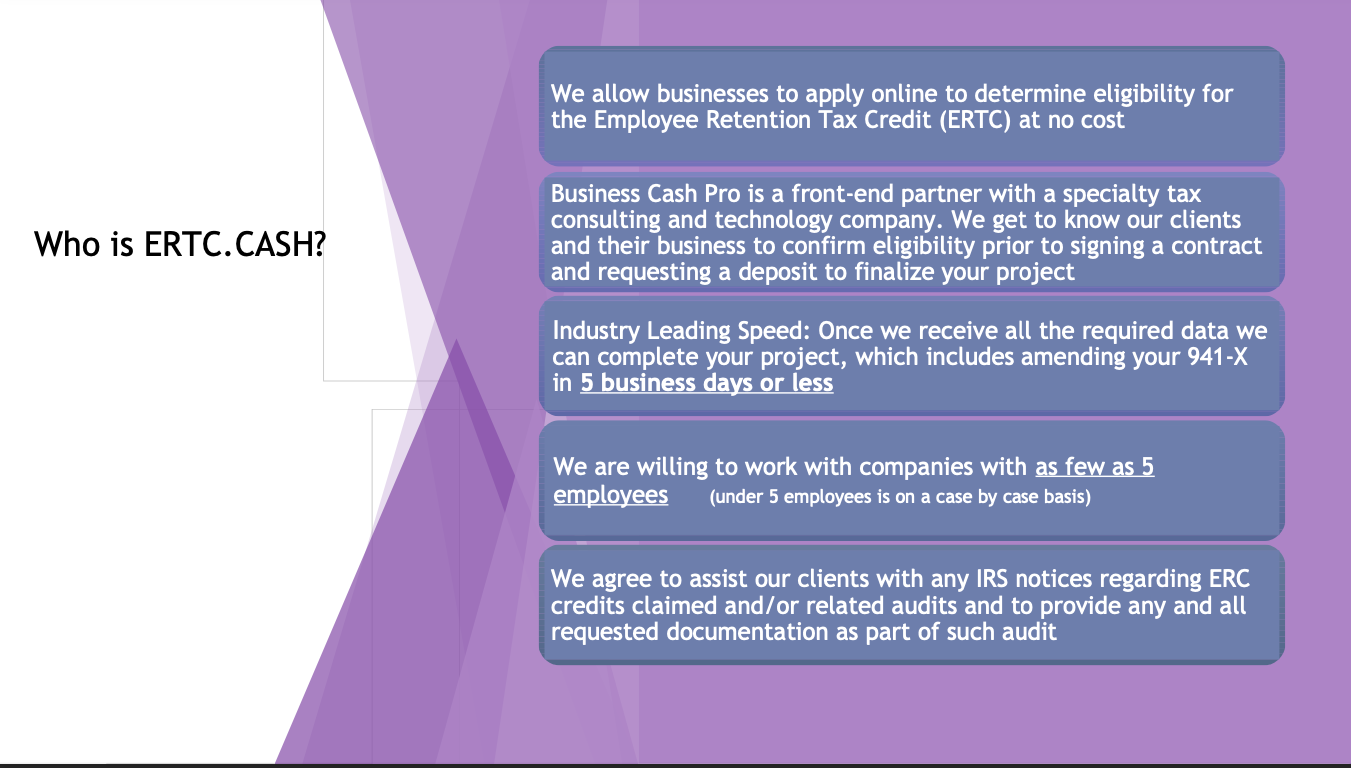

The newly launched eligibility checking service is aimed at you if you have five W-2 employees or more. ERTC.CASH states you may wrongly believe the CARES Act Employee Retention Tax Credit (ERTC) must be paid back. This is a common misconception. The payment is a check, not a loan, never needs to be paid back, and can be used for whatever purpose the business owner wants to use it for.

You can find out more at https://www.ertc.cash

Did you keep employees on during the health crisis? The Employee Retention Tax Credit program rewards employers like you. It has been extended beyond 2020. The new service can help you if you’ve missed out, as you can apply to the program retroactively. This gives you the best chance of surviving current economic uncertainty.

You may not be aware of this, but ERTC.CASH states that in March 2021, the rules around the Paycheck Protection Program (PPP) and ERTC were changed. This means if you have already applied for PPP, you can still apply to receive ERTC. Business owners can apply for up to $5,000 for each employee in 2020, and $7,000 for each employee for the first three quarters of 2021. The maximum total for the program is $26,000 per W-2 employee.

When you contact ERTC.CASH to use the new eligibility checker service, you will be required to answer some basic questions to enable the company to perform an analysis. There is no cost to determine eligibility for a rebate, which gives you peace of mind.

Those who apply will work with CPA's who specialize in the ERTC program. They are well placed to answer any queries business owners have as they understand the rules around this program. As they handle these claims daily, they are aware of updates or changes to legislation.

A company spokesperson said: “If you thought the tax credit was for 2020, you’re right. It was originally a 2020 credit. And it was either the Paycheck Protection Program (PPP) or ERTC. Almost every business chose the PPP option.”

“ERTC was not widely used until March 2021, when the American Rescue Act changed IRS regulations and millions of businesses were now eligible for both the PPP and ERTC program by amending their quarterly 941 form,” they added.

We are living through challenging times. But you are not alone! Have you applied for the Employee Retention Tax Credit? You may be surprised to learn you could be eligible to receive thousands of dollars per employee, just because you kept them on during the lockdown and slowdown caused by the health crisis!

Go to https://www.ertc.cash so you can find out more!

Sponsor Ads

Created on Dec 14th 2021 11:01. Viewed 186 times.