Akzo Nobel India Ltd – Colouring Lives

Akzo Nobel India Ltd manufactures and markets wide range of coatings and specialty chemicals. It is the 4TH largest

paints company in India with an overall market share of around 11% .The

Company operates through the following segments: Performance Coatings,

Decorative Paints and Specialty Chemicals. The Performance Coatings

segment produces aerospace and automotive; industrial; marine and

protective; and powder coatings. The Decorative Paints segment

manufactures and supplies a variety of exterior and interior decoration

and protection products for professional and Do-It-Yourself (DIY)

markets. The Specialty Chemicals segment manufactures industrial,

functional, pulp and performance chemicals.

Akzo Nobel India Ltd is one of the Multibagger Stocks, identified by Dynamic Research based on technical and fundamental research.

Akzo Nobel India share price has

touched a 52 week high of Rs. 1705 on 29 -Jul -2016 and a 52 week low

of Rs.1205 on 12 -Feb -2016, and is currently trading at Rs. 1602.

Share Holding

The promoters holding in the company stood at 72.96%, while Institutions

and Non-Institutions held 10.48% and 16.56% respectively.

Financial Analysis

Quarterly Results

For the quarter ended June 2016, the total income from operations of

Akzo Nobel India Ltdhas reported a growth of 6.83% on Y-o-Y basis to Rs.

703.39 cr as against Rs. 658.40 cr during the same quarter last year. A

boost up in total income from operations shows strong development in

business.

The operating profit of Akzo Nobel on standalone has shown a growth of

39.67% Y-o-Y to Rs. 84.64 cr as against Rs. 60.60 cr during the same

quarter last year; this is mainly due to higher net sales.

The net profit of Akzo Nobel has registered a growth of 41.82% Y-o-Y to

Rs.64.26 cr as against Rs 45.31cr during the same quarter previous year.

The earnings per share of the company have showed a growth of 41.81%

Y-o-Y to Rs. 13.77 as against Rs. 9.71 during same period last year.

The

financial performance for this quarter has been positive and the

company is growing consistently despite tough market conditions.

Annual Results

For the year ended March 31, 2016 Akzo Nobel India Ltdon Standalone

basis reported net sales of Rs. 2740.14 cr compared to Rs. 2526.99 cr

FY2015.

For the year ended March 31, 2016 Akzo Nobel India Ltdon Standalone

basis reported net profit of Rs. 202.10 cr compared to profit of Rs.

186.31 cr FY2015.

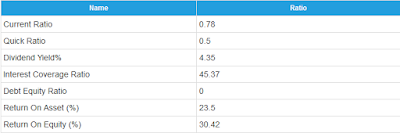

Ratio Analysis

The above ratio suggests that the company is operating with zero debt.

Higher Interest Coverage Ratio implies that company can very easily pay

interest on outstanding debt. The management is efficiently using its

assets to generate earnings. The Company is generating very good returns

with the money the share holders have invested;

Investment Rationale

- Indian

paints industry is estimated at Rs.406 Bn, out of which organized

sector accounts for ~65% (~Rs.264 Bn) of the total market.

- The Indian paints market has substantially grown and caught the attention of many international players

- Akzo

Nobel manufactures and markets wide variety of coatings under brand

name of “Dulux” holding second position in finest paints category with

around 20% market share in premium segment.

- Presently,

the growth of the Indian paints industry is being witnessed in Tier-II

and Tier-III cities as compared to urban cities. The growing popularity

of quality paints and rising income levels of people residing in Tier-II

and Tier-III cities have pushed the growth in premium paints market of

Indian decorative paints industry.

- Decorative

industry size is expected to double to around Rs.460 Bn by year 2020

driven by demand from urbanization and revival in realty industry.

- Akzo

Nobel is one of the largest beneficiaries of fall in global crude oil

prices as crude-linked raw material forms around 35% of the total raw

material cost including packaging.

- With good monsoon rains and impending festive season, the company expects a good offtake in the coming months.

The Board of

Directors has approved, setting up a Powder Coating manufacturing

facility in Mumbai, with an installed capacity of 7000 tons.

Investment Opinion

At CMP of Rs. 1607

the stock is trading at a P/E of 33.80, the market cap of the company

is 7475.92 crore. As per Dynamic Levels we recommend a buy on Akzo Nobel

at CMP 1602 levels with a price target of Rs. 1750.

Advertise on APSense

This advertising space is available.

Post Your Ad Here

Post Your Ad Here

Comments