2 FTSE 100 Telecom Stocks to Focus After KPN Shares Fall

Dutch telecommunications company KPN NV (AMS: KPN) announced a joint venture with Dutch pension fund ABP to help accelerate its fibre optic roll out project on Tuesday 23 March, leading KPN’s shares to fall sharply during trading hours as the deal reduced KPN’s takeover possibility.

KPN’s shares closed at EUR 2.84, down by 1.70 per cent on 23 March following the news. KPN had earlier negated rumours of a takeover from Sweden-based private equity firm EQT in October and later in November 2020.

ABP will finance the project with EUR 440 million and will have a 50 per cent ownership of the JV entity. The JV plans to add up to 910,000 fibre optic connections in homes and businesses by 2026, targeted primarily in underserved locations.

In this article, we take a look at 2 FTSE 100 listed telecom stocks with a five-year average dividend yield of over 5 per cent:

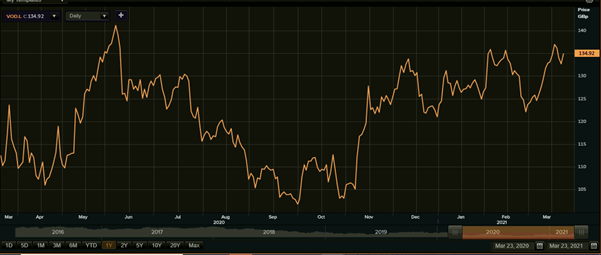

- Vodafone Group PLC (LON: VOD)

FTSE 100 listed and UK-based telecom giant Vodafone Group PLC announced the launch of 10 separate but simultaneous cash tend offers on 19 March. The offer period started on 19 March and will end on 26 March.

The move comes days after the company floated its tower infrastructure arm on the Frankfurt stock exchange.

(Source: Refinitiv, Thomson Reuters)

Vodafone’s shares closed at GBX 134.10, up by 1.09 per cent as of 23 March, while the FTSE 100 index, which it is a part of, closed at 6,699.19, down by 0.40 per cent.

Read here: https://kalkinemedia.com/uk/stocks/communication/2-ftse-100-telecom-stocks-to-focus-after-kpn-shares-fall

Post Your Ad Here

Comments