How to void a check in QuickBooks?

You realize you've written a check in the wrong amount, or you've sent it to the wrong vendor because you have so many to keep track of and sometimes things get mixed up.

What's worse: you wrote a check before you checked your bank account balance, and now your check might bounce due to insufficient funds. You don't want your vendor to have to deal with a bounced check fee, nor do you want to pay any penalty your bank enforces upon you. You also don't want to deal with the embarrassment that comes with a bounced check—that could be bad for business!

Before you get into any sticky situation regarding a bad or accidental check, you can void payment right in QuickBooks Online. Here's how.

And click here or scroll to the bottom for more info on hiring a robot accountant to handle your daily bookkeeping—that way, you can avoid any financial surprises from happening ever again!

What does it mean to void a check?

Avoided check simply means that you cancel out the original transaction. When you void a check, the record of the check remains in your QuickBooks Online account, but the check's dollar amount changes to zero. The check number, payee, date, and memo field also stay in your records so you can later reference the voided transaction.

How to void a check in QuickBooks Online?

To void a check that wasn't cashed or included in your most recent bank reconciliation, follow these steps.

- Click "Accounting" in the menu on the left.

- At the top, select "Chart of Accounts."

- Choose the bank account from which the original check was issued, and select "View Register."

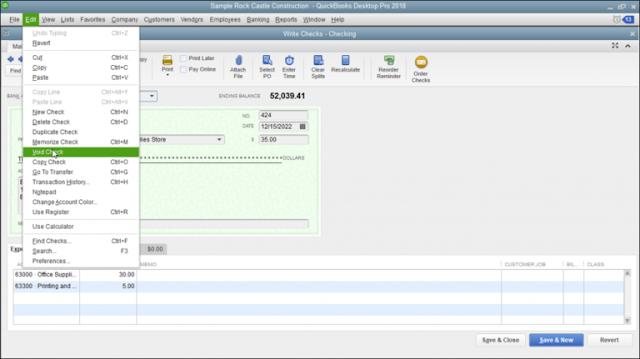

- Find the check you need to void, click on it to highlight it, then click "Edit."

- At the bottom in the center, click "More," and select "Void." You will be asked to confirm your decision to void this check.

What if my check was included in a previous reconciliation?

To void a check that was included in a previous bank account reconciliation, you'll need to undo the reconciliation, and then you can proceed with the steps listed above to void the check. After that, you can move forward with reconciling your account so your general journal and reports stay in good shape.

Voiding a check is far from the craziest thing you'll have to do running an SMB, but it's very important knowledge to have in order to keep your accounts up to date and your business running smoothly. Having an efficient accounting system in place helps prevent any bad financial surprises from arising, and that starts with having solid bookkeeping knowledge.

For more helpful QuickBooks Online tutorials, like how to add your accountant or how to get the most out of QuickBooks Online, check out our QuickBooks Tutorials page on our blog.

Better yet, learn how you can make the most of your time by hiring a robot accountant to manage your day-to-day bookkeeping. Automated bookkeeping saves you time and money, and it's far more accurate than human accounting, which is often manual and riddled with errors.

If you have any query residing in your mind, then you are open to call + 1-888-412-7852 us anytime.

Source: https://sites.google.com/view/void--check-in-quickbooks/home

Comments