Digital Currency, Bitcoin

by Arzu ALVAN macroeconomicsIs Bitcoin making a significant impact on global financial transactions?

Digital currencies can be considered as important technological developments that transform the money-based economic system we are in. So what exactly is this thing called digital money? Can Bitcoin-like currencies be considered as a revolt against the central authorities? Or rather, is it a revolt against the management of money and many economic and social activities from central structures, imposed by the money economy-based capitalist system that has been going on for nearly three centuries?

We can say that credit cards and debit cards used in shopping in daily life are digital currencies created by the banking system. On the other hand, non-financial institutions can also produce digital money without the need for regulatory standards. In this way, new types of currencies can be created. Right here, Bitcoin is a sophisticated type of digital currency used for payments and money transfers made by non-financial units online without the need for financial institutions to be a third party or intermediary.

We can say that the concept of digital currency began to be expressed for the first time with DigiCash, which was established in 1990. Money transfer companies such as PayPal followed suit. Thus, it has become an indispensable element of internet shopping more and more on a global scale with the opportunities brought by the developing technology and the widespread use of the internet. In 1998, although the creation of a decentralized digital currency like Bitcoin was started to be considered, the work continued for a while when it did not give the desired results such as reliability and verifiability.

In 2008, the outbreak of a global financial crisis brought the concept of digital currency back to the agenda. The outbreak of the crisis was a kind of opportunity. For the first time, the dream of creating a decentralized financial system with digital currency was becoming a strong possibility.

There are digital currencies with different complex technologies that are starting to appear in the financial markets today. Digital money was defined by the IMF in 2008 in two main categories. One of them is hardware-based digital currency while the other is software-based digital currency. An example of a hardware-based digital currency is credit cards issued by banks. Software-based cryptocurrencies, on the other hand, are those used for remote transactions.

Blockchain-based Bitcoin software, developed by a software developer, whose pseudonym is said to be Satoshi Nakamoto, together with a group of software developers, came to the fore in January 2009.

Blockchain technology, in short, is a peer-to-peer network type and a technology that terminates duplicate transactions with transaction records of all users made with cryptography. The system is decentralized, making hacking difficult but not impossible.

What makes Bitcoin privileged is that it is a decentralized currency that cannot be controlled by any group. Despite what it may seem like, we’ve only recently seen a market fluctuating with a tweet from investors like Elon Mask, who owns large amounts of Bitcoin.

In February 2017, there were about 720 cryptocurrencies. Bitcoin made up about 80 percent of the cryptocurrency market. As of February 2017, the total market capitalization of all cryptocurrencies was around $19 billion, with the top 15 currencies accounting for more than 97% of the market, with 7 of them contributing 90% of the entire market cap.

When we look at the academic literature, we see that there are a significant number of studies on Bitcoin. These studies gained momentum as of 2012. Most of these studies are done in engineering fields. The most emphasized subjects in the studies are on the technical infrastructures of cryptocurrencies. Some of these studies are briefly as follows: Ryan Farell examined the cryptocurrency market using the “consensus mechanism” in his study published in 2015 (Ryan Farell (2015). An analysis of the cryptocurrency industry. Wharton Research Scholars; http://repository.upenn.edu/wharton_research_scholars/130). In the study, it was emphasized that the Bitcoin industry is quite reliable against major thefts.

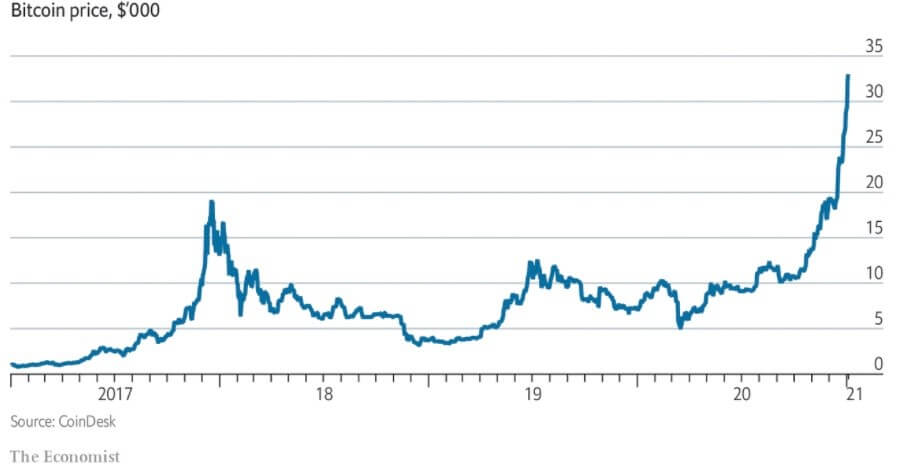

The first payment transaction using Bitcoin was among the users of the “Bitcointalk forum” in 2010. In this transaction, two pizzas were purchased with 10000 Bitcoin. As of January 1, 2011, one Bitcoin was worth $0.30, with the total market cap exceeding $1 million. Bitcoin peaked at around $20,000 in December 2017 and accompanied the rise in popularity of the cryptocurrency. December 2018, 2019, 2020 reached $3743.91, $7301.07, $27036.69 respectively.

Finally, as of July 2021, it is at the level of 33 thousand dollars. The total value of the market is at the level of 1 trillion dollars as of the same month. Although it is still far below the total value of the global financial market, its progress is remarkable.

In my ongoing articles, I will share the academic study results of Bitcoin’s contribution to the financial market, please stay tuned.

Sponsor Ads

Created on Oct 5th 2021 03:23. Viewed 243 times.